In a significant turn in the global race for critical minerals, the United States has surpassed China as Africa's largest source of foreign direct investment, marking a strategic pivot amid escalating tensions over resources vital for technology and defense.

Investment Surge and Key Figures

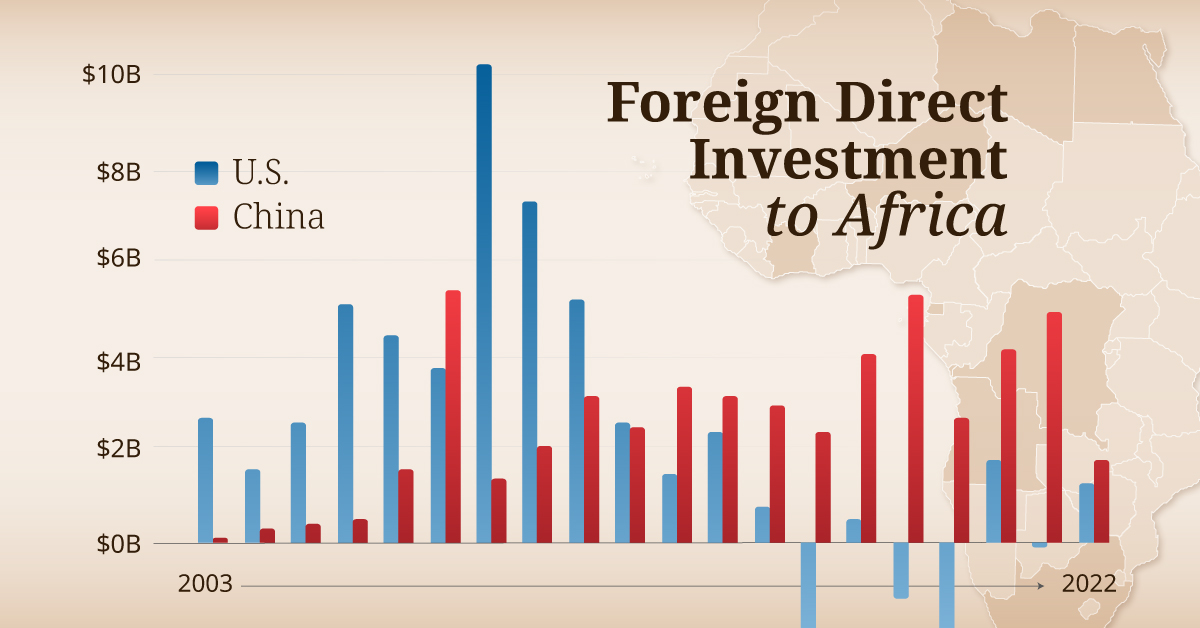

Recent data from the China Africa Research Initiative at Johns Hopkins University reveals that in 2023, US investments in Africa reached $7.8 billion, outpacing China's $4 billion. This is the first time since 2012 that the US has led in FDI to the continent, signaling a deliberate effort to challenge China's dominance in mining and resource extraction. The shift is driven by the US International Development Finance Corporation (DFC), established in 2019 to counter Chinese influence. Examples include a $3.9 million DFC grant to Rwanda's Trinity Metals for developing mines producing tin, tantalum, and tungsten, which are exported to US processing plants. Another project is ReElement Africa's refinery in South Africa's Gauteng province, aimed at local mineral processing to retain value on the continent. These investments focus on critical minerals like lithium, cobalt, and rare earths, essential for electronics, electric vehicles, and military applications. Africa's vast reserves make it a battleground, with China historically controlling much of the global supply chain through heavy investments and export threats.

The US's approach emphasizes conflict-free, ethical mining, contrasting with some criticisms of Chinese projects.

The DFC's role has been pivotal, providing funding for projects that align with high standards, including no child labor and environmental respect. Trinity Metals, partially owned by the Rwandan government and Irish firm TechMet, exemplifies this, exporting tungsten and tin to Pennsylvania. The initiative not only secures supply chains but also promotes job creation and community benefits in Africa.

Strategic Motivations Behind the Shift

The US's overtake is rooted in national security concerns over China's control of critical minerals, prompting a policy to diversify supply chains and reduce dependence on Beijing. The DFC explicitly aims to counter China's Belt and Road Initiative, which has poured billions into African infrastructure and mining since the early 2010s. Economic rivalry is intensified by China's threats to restrict exports, affecting US tech and defense industries. For Africa, this means increased bargaining power, but also the need for strategic negotiations to avoid exploitative deals. The timing aligns with global transitions to green energy, heightening demand for African minerals.

US tariffs under Trump have complicated relations, potentially hindering further gains.

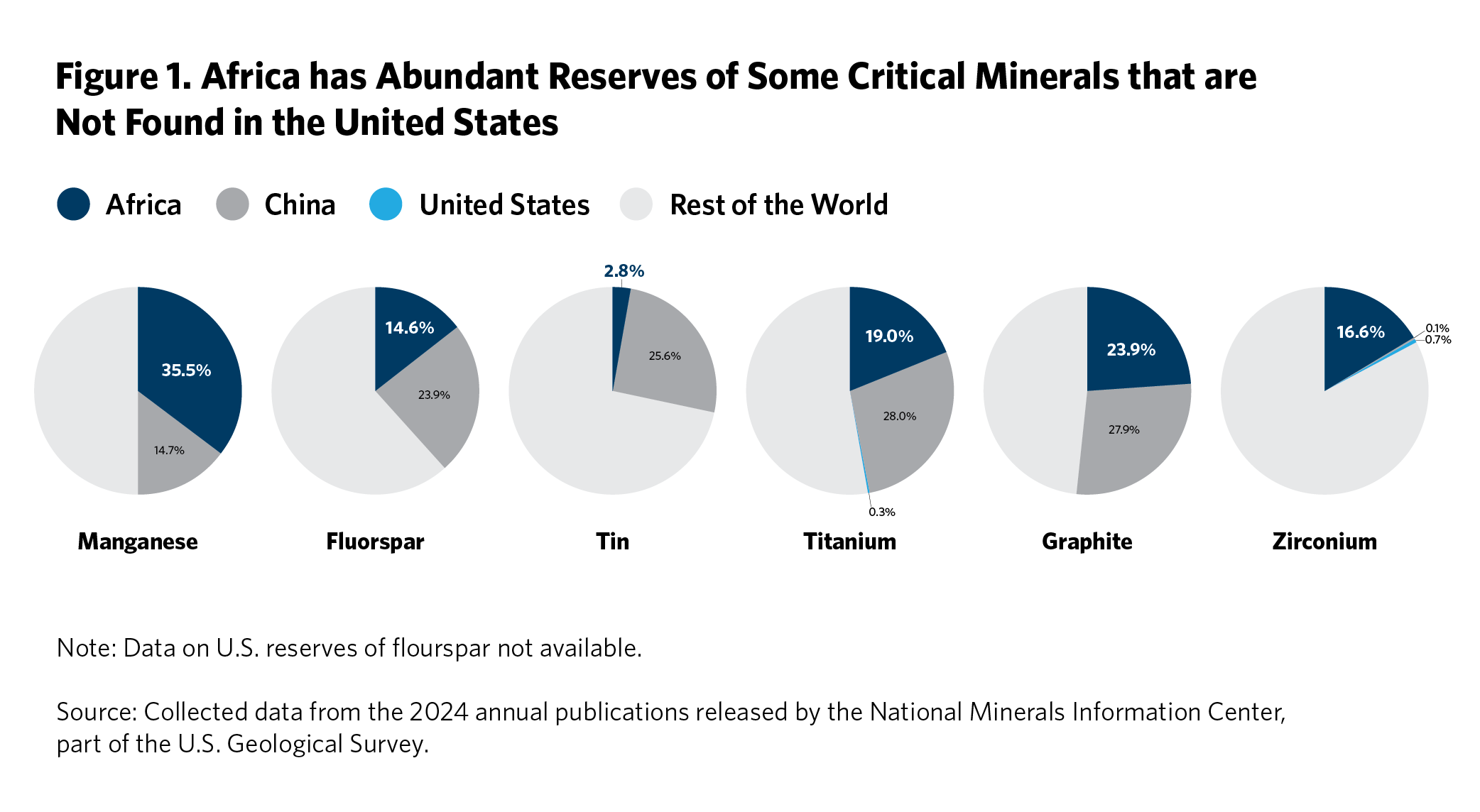

Africa's role is crucial, as it holds abundant reserves not found in the US, like manganese and graphite. The shift encourages local processing to capture more value, fostering economic development.

Insights from Industry Leaders

Shawn McCormick, chairman of Trinity Metals, stated, "The US government has been very supportive of what we've been doing, to look at bringing that supply chain directly to the United States." He emphasized ethical production: "We have shown that there is a way to produce these materials in a conflict-free, child-labor-free way that is professionalized." Sepo Haimambo, economist at FNB Namibia, advised, "Africa really needs to prepare itself for these engagements and be really clear on what outcomes it wants." Prof. Lee Branstetter from Carnegie Mellon University criticized US tariffs: "Had the current administration not indiscriminately slapped tariffs on large numbers of African countries, the United States would probably have been in a better position." These opinions highlight the need for balanced partnerships.

Outlook for Future Investments

Expect intensified competition, with the US pushing for more ethical, value-added projects. Africa may see diversified partners like Brazil and India. If tariffs ease, US investments could accelerate, benefiting local economies through sovereign wealth funds and infrastructure. However, without assertive negotiations, Africa risks missing out on full benefits.

Long-term, this could reshape global supply chains, reducing China's monopoly.